Leveraging AI for Personalized Financial Advice

The integration of artificial intelligence (AI) in the financial industry has revolutionized the way financial institutions operate. AI algorithms are being utilized to analyze vast amounts of data in real-time, providing more accurate and timely insights for decision-making processes. This enhanced computational power has enabled financial firms to better understand market trends, customer behavior, and risk factors, ultimately leading to improved efficiency and profitability.

Moreover, AI technologies are also being employed in enhancing customer experiences in the financial sector. By leveraging AI-powered chatbots and virtual assistants, financial institutions can provide personalized and responsive services to their clients. These tools enable quick and efficient communication, allowing customers to receive instant support and guidance for their financial needs. The automation of routine tasks through AI not only saves time and resources but also enhances overall customer satisfaction and loyalty.

Understanding Personalized Financial Advice

In the realm of financial services, the provision of personalized financial advice has seen a significant shift with the advent of artificial intelligence (AI). Gone are the days of generic recommendations; AI technology allows for tailored financial advice that suits individual needs and goals. By analyzing vast amounts of data and utilizing sophisticated algorithms, AI can offer insights and suggestions that are precise and specific to each client. This tailored approach not only enhances the client experience but also boosts the effectiveness of the financial advice provided.

• AI technology allows for tailored financial advice that suits individual needs and goals

• Analyzing vast amounts of data and utilizing sophisticated algorithms helps in offering precise insights and suggestions

• Personalized financial advice enhances the client experience

• Tailored approach boosts the effectiveness of the financial advice provided

The Role of Artificial Intelligence in Financial Planning

Artificial Intelligence (AI) has become an integral part of the financial planning landscape in recent years. Its ability to analyze vast amounts of data in real-time allows for more accurate predictions and efficient decision-making processes. By incorporating AI into financial planning practices, advisors can offer clients personalized insights and recommendations tailored to their specific needs and goals.

Furthermore, AI enhances the efficiency of financial planning by automating repetitive tasks such as data entry, risk assessment, and portfolio rebalancing. This automation not only saves time for financial planners but also reduces the margin of error, leading to more precise and reliable outcomes. As technology continues to advance, the role of AI in financial planning is expected to expand, providing even more sophisticated solutions to help individuals achieve their financial objectives.

How is artificial intelligence changing the financial industry?

Artificial intelligence is revolutionizing the financial industry by providing more efficient and accurate data analysis, enhancing decision-making processes, and offering personalized financial advice to clients.

What is personalized financial advice?

Personalized financial advice is tailored guidance based on an individual’s specific financial goals, risk tolerance, and investment preferences. This type of advice is made possible through artificial intelligence algorithms that analyze vast amounts of data to provide customized recommendations.

How does artificial intelligence play a role in financial planning?

Artificial intelligence plays a crucial role in financial planning by streamlining the process of collecting and analyzing financial data, creating personalized financial plans, monitoring investment performance, and adjusting strategies based on changing market conditions.

Can artificial intelligence replace human financial advisors?

While artificial intelligence can augment the capabilities of human financial advisors by providing data-driven insights and recommendations, it is unlikely to completely replace the need for human expertise and personalized guidance in complex financial planning scenarios.

How secure is the use of artificial intelligence in financial planning?

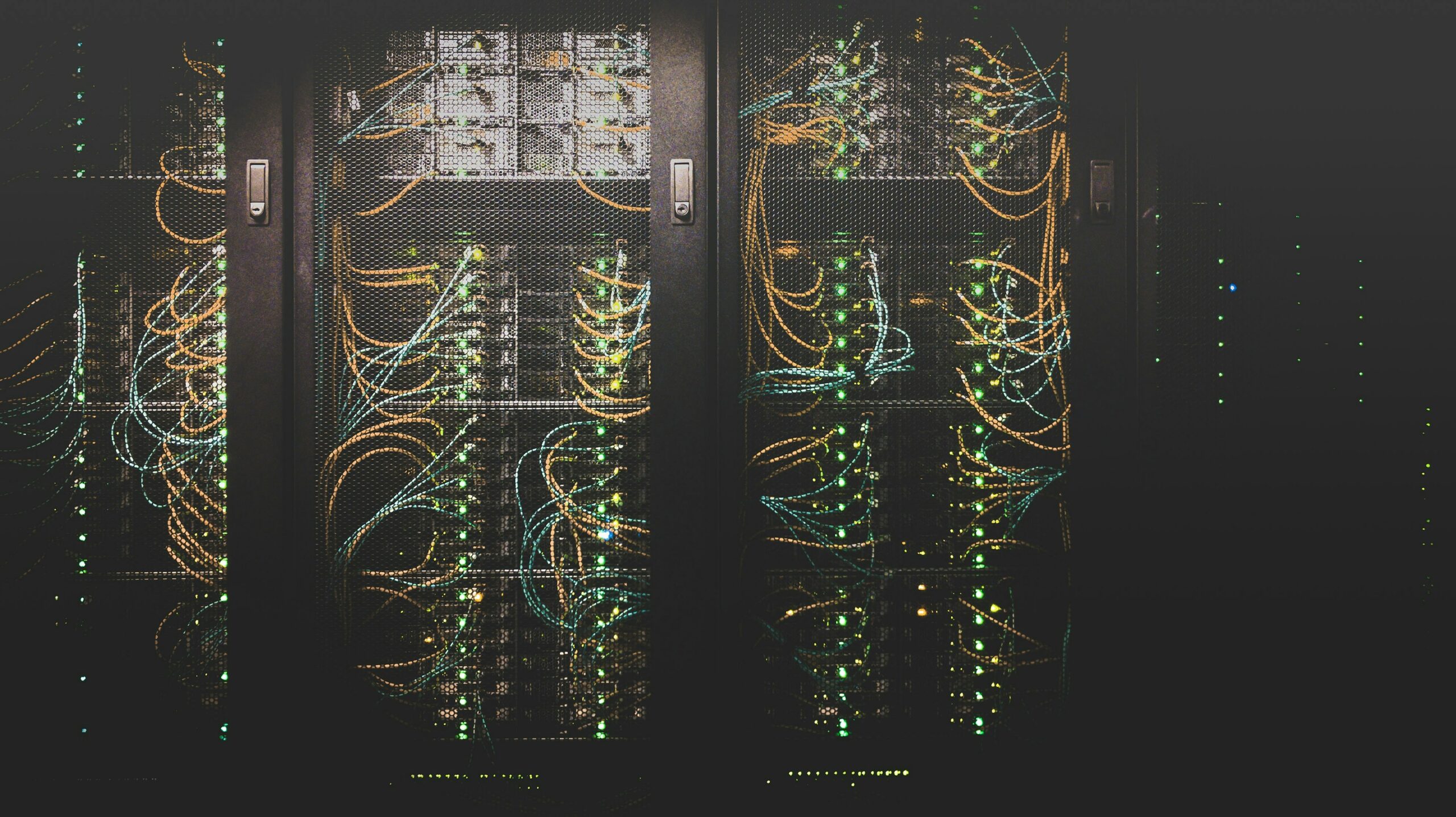

The use of artificial intelligence in financial planning is subject to stringent security measures to safeguard sensitive financial data. Financial institutions and technology providers invest heavily in cybersecurity protocols to protect against data breaches and ensure the privacy of client information.